Elon Musk, the chief executive of Tesla Inc, reiterated his backing of Bitcoin at a conference Wednesday, saying he owns the token along with Dogecoin and Ethereum.

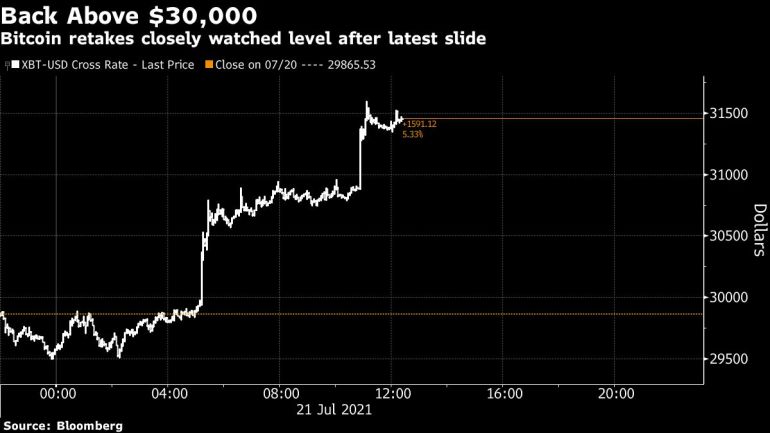

Bitcoin extended gains past $32,000, continuing a rebound after erasing most of its gains for the year. The latest leg up came in as Elon Musk, Jack Dorsey and Cathie Wood spoke during a panel on the future of Bitcoin.

The largest digital currency rose more than 8% to about $32,270 as of 2:27 p.m. in New York on Wednesday. Other cryptos advanced too, including Ether and Dogecoin, while the Bloomberg Galaxy Crypto Index was also in the green.

Musk, the chief executive of Tesla Inc., reiterated his backing of Bitcoin, saying he owns the token along with Dogecoin and Ethereum. He also said Space Exploration Tecnologies Corp. also owns Bitcoin, like Musk’s electric-car company.

The token bounced back after sliding below $30,000 earlier in the week, its first foray there since June.

“The fear in the market was that if Bitcoin breaks below the $30,000 mark, the price will move lower violently,” said Naeem Aslam, chief market analyst with Ava Trade Ltd. “In reality, that is not what we have seen. The Bitcoin price has been stable, and we have not seen any panic selling.”

Bitcoin and other cryptocurrencies have tumbled since mid-May, wiping some $1.3 trillion off their market value. Bitcoin has faced a range of obstacles, including stepped up regulatory scrutiny in China, Europe and the U.S. and concerns about the energy needed by the computers underpinning it. Investors have also generally become more cautious about speculative assets.

Bitcoin may still test the $25,000 support level in the coming weeks, Ava Trade’s Aslam said. A break above $32,000 would herald a stronger recovery, according to Steen Jakobsen, chief investment officer at Saxo Bank.

“Bitcoin and Ethereum did manage to pull a rally together after Bitcoin had dropped down through the key $30,000 area yesterday, but really needs to recover above $32,000 sustainably to dig itself out of a hole,” Jakobsen wrote in a note.

Bitcoin’s advance this year has shrunk to about 8% following a slide from an April record of almost $65,000. That compares with a 15% jump in the S&P 500 index in 2021.

Proponents argue the virtual currency offers an inflation hedge and will win wider institutional acceptance. Such narratives were always controversial and are now under even more question, though Bitcoin’s most ardent fans continue to predict big long-term returns.

“Regulatory and environmental concerns will likely keep Bitcoin heavy but improvements on both fronts should happen before the end of the year,” Edward Moya, senior market analyst for the Americas at Oanda, wrote in a note. He added institutional investors “are ready to place big long-term bets” if a plunge toward $20,000 is avoided.