When the Sage of Omaha, Warren Buffett, bets on gold miners, you sit up and take notice. Remember, betting on gold miners is riskier than betting on gold if you fear you are near the top of the cycle but far more rewarding if you think there’s more runway ahead—as miners make outsized profits when the yellow metal gains, but the reversal is as sharp when the tide turns. So gold mining stocks would tend to outpace gold on the way up and down.

There’s another reason to be betting selectively on gold miners: increased scrutiny on greenhouse emissions by ESG investors could hurt the less compliant and crimp their output. But that’s another debate altogether.

Coming back to the case for gold, the unprecedented money printing in the wake of the COVID-19 pandemic raises the spectre of inflation and currency devaluation globally, which makes the yellow metal a good candidate as a store of value.

(Economic theory suggests that as money supply in an economy increases, it causes prices to rise – as more money chases the same number of goods and assets. High inflation renders the economy less competitive than others, leading to a devaluation of its currency. Gold derives its value partially from the fact that it has been used as a currency historically, and because enough people believe it is still a store of value. As a result, it tends to rise during periods of uncertainty or when there is high inflation or fear of it.)

Under such circumstances, and with the US Federal Reserve indicating that it will not up interest rates for at least another 2-3 years and till inflation tops 2 percent, there is a need to hedge against rising inflation and negative real interest rates.

In fact, Goldman Sachs’ Chief Commodity Strategist, Jeffrey Currie, has projected gold to scale to $2,300 on expectations of higher inflation and the risk of dollar losing its reserve currency status.

END OF THE DOLLAR REIGN?

In fact, that’s one of the biggest raging debates in recent times: will the dollar lose its current reserve currency status? Reserve currencies are basically currencies that countries keep with them to facilitate international trade, with the US dollar being the dominant medium of exchange (about 60 percent of global trade).

But to understand how this came to be, it helps to take a short walk back in time.

From 1816 to 1914, the world mostly used gold as the standard for exchange — and central banks printed currencies to the extent of reserves of gold they had in their possession.

That period saw few financial crises — though some argue that the financial stability was the reason why the gold standard continued efficiently instead of the other way around.

The period between the World Wars till 1939 saw countries follow a mixed framework of gold standard and floating rates.

It also saw the UK being displaced by the US as the financial powerhouse. The 1940s saw a post-war monetary system evolve with the Bretton Woods Agreement coming into play in 1944 with 42 countries agreeing to an adjustable dollar-peg for their currencies. The agreement also led to the setting up of the World Bank and International Monetary Fund.

But gold still played a role as exchange for currency, and this was halted by US President Richard Nixon in 1971 to prevent depletion of the country’s gold reserves. Thus the dollar was finally unhinged from gold. This was followed by the US and UK suspending capital controls in 1974 and 1979, respectively. Thus the present managed floating rate exchange system that exists today came into being.

But is the existing system robust enough to continue for a few more decades? Is this then the end for the dollar as we’ve known it? Those are zillion-dollar questions. Interestingly, and this not my observation but borrowed wisdom, the exchange systems have historically lasted for 30-40 years. So it may just be time for another reset. And if that’s the case, it makes even more sense to keep some money in hedges like gold, or bitcoin.

GOLD OR BITCOIN?

Bitcoin is being positioned as the new digital gold. And of late, its legitimacy has leaped with several institutional investors, even pension funds, moving part of their allocation from gold to bitcoin. That’s positive bitcoin and negative gold. But here it is important to note that gold still remains the big bet, and Bitcoin for most is only a nominal diversification—though even that is big money to fuel a bitcoin rally.

In a recent Greed & fear note by Jefferies’ Chris Wood, he argues for an allocation by pension funds to bitcoin, while keeping the faith in gold. To quote: “…introduce an investment in Bitcoin in GREED & fear’s long only global portfolio for US dollar-denominated pension funds…. The 50% weighting in physical gold bullion in the portfolio will be reduced for the first time in several years by five percentage points with the money invested in Bitcoin”. On the case for gold, it adds: “the yellow metal should rally again if the Fed stays doveish in the face of the dramatic cyclical recovery that is coming on the other side of the pandemic… GREED & fear’s base case is that the Fed remains doveish even if only because the system cannot afford higher rates”.

| JEFFERIES’ LONG-ONLY PENSION FUND PORTFOLIO ALLOCATION | |

| Investment type | Weight (%) |

| Physical gold bullion | 45% |

| Asia ex-Japan equities, weighted according to the long-only thematic portfolio | 30% |

| Unhedged gold mining stocks | 20% |

| Bitcoin | 5% |

Here it is interesting to note Jefferies’ portfolio allocation, which has an outsized exposure to gold—physical and via mining stocks—of 65% and only 30% in equities.

And while I’m still unconvinced about bitcoin—I prefer gold hands down—a small exposure on grounds of FOMO (or fear of missing out) within the hedge allocation may not be imprudent, especially given the institutional endorsement.

THE CASE FOR INDIAN GOLD

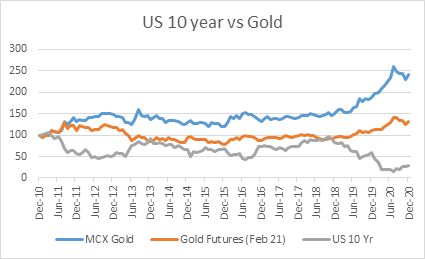

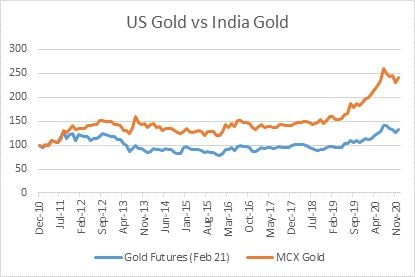

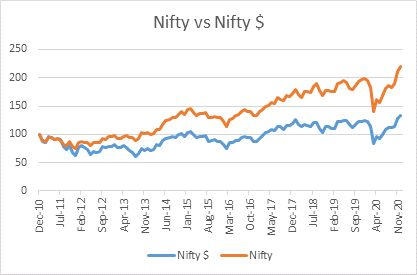

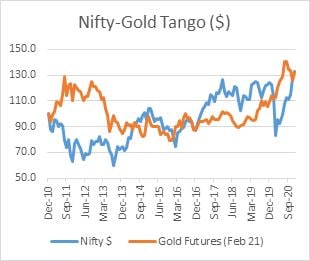

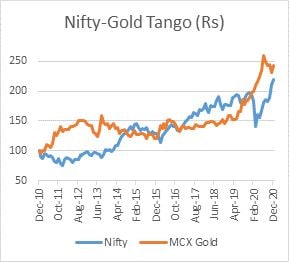

To try and understand investing in gold better and the associated risks, we did some analysis of its historical behavior over the past decade. Here’s what we found: gold pipped the Nifty in rupee returns, gold has a negative correlation with US interest rates (or inflation) and gold gains when the Re slips against the US$.

| HOW GOLD CORRELATES | |||||

| Gold Derivative | US 10 Yr | $ Index | USD/INR | Nifty $ | Nifty |

| US Gold Futures | -0.6 | -0.3 | 0.1 | ||

| MCX Gold | -0.74 | 0.37 | 0.67 | 0.59 | |

| RETURNS (10 Yr CAGR) | |

| Instrument | % |

| USD/INR | 5.16 |

| US Gold Futures | 2.88 |

| MCX Gold | 9.25 |

| Nifty | 8.22 |

What is evident from the above is that gold acts as a hedge against currency risk and this helps it deliver higher rupee returns. What’s also interesting to note is that Indian gold and the Nifty are positively correlated. Interestingly, even in the case of Nifty, while the rupee returns were above 8 percent on a 10-year compounded basis, the returns for the Nifty US$ were under 3 percent.

However, gold is clearly the better hedge against currency and rate risk. And in the current context where we are likely to see inflation start to rise but a lag in rate action by the US Federal Reserve and other central banks, as well as more money printing, with more stimulus in the works, the case for gold becomes stronger.

In fact, an alternative to taking some money from equities (given the lofty valuations) and converting it into cash, or near cash-holdings, like many investors are doing would be to invest some such sums in gold.