Filecoin (FIL) is the native token of the Filecoin network.

Filecoin aims to decentralise web storage, providing an alternative to cloud computing services like Amazon Web Services as well as content delivery networks like Cloudflare. Filecoin allows almost anyone to provide storage in return for cryptocurrency. This means the Filecoin network is made up of a wide range of storage providers, from dedicated companies with fully fledged data centres to home users offering up the spare space on their home PC.

Check out the table below for a list of exchanges to buy Filecoin, or keep reading for an explainer of the Filecoin network and FIL coin.

Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific

provider, service or offering. It is not a recommendation to trade.

What is DeFi? Read the beginner’s guide.

How does Filecoin work?

| Circulating supply (approx. as of September 2020) | 36,962,319 |

| Maximum supply | 2,000,000,000 |

| Blockchain | Filecoin |

| Purpose | Utility token |

Filecoin is essentially a network of miners who provide storage and retrieval services, and clients, who utilise the storage available. It runs on the InterPlanetary File System (IPFS) protocol which connects users in a peer-to-peer manner.

For instance, a server farm might take advantage of the Filecoin network to make money off its unused storage space, while a video streaming platform might pay to store its content there. Payment is settled in FIL.

Unlike centralised storage systems, where a single company provides all the storage infrastructure, anyone can join the network in return for depositing FIL proportional to the amount of storage they are selling.

This means both miners and clients need to own Filecoin in order to use the network.

Contracts for storage between parties are known as deals, which are settled via bids from both sides on the native Filecoin marketplace. This system could be thought of as similar to a decentralised cryptocurrency exchange, where the marketplace acts as an intermediary matching buy (bid) and sell (ask) orders. The idea here is that free-market economics will lead to dynamic pricing for storage.

Once a deal is settled, payment is made upfront in full for the lifetime of the deal. This is in contrast to legacy cloud storage systems, which usually employ a pay-as-you-go model. Another quirk of this system is that both sides are subject to the volatility of the FIL price until the deal is settled.

What does Filecoin do?

Filecoin’s native token FIL is used for payments on the network, as well as held by miners as collateral in order to use the network.

Contracts between miners (storage providers) and clients (storage buyers) are settled through bids on an open market, using Filecoin as payment.

Filecoin tokens are also used to settle microtransactions on the network, such as when data is pulled from multiple storage locations on demand.

In addition to receiving payments, miners can also earn Filecoin simply by offering space, even if it goes unused. This is so there is a given amount of free storage on the network at any given time.

In return for providing storage space on the network, miners are rewarded with newly minted Filecoin tokens, in addition to the tokens they receive as payment from clients.

What to watch out for

Filecoin is a highly inflationary cryptocurrency, which means it may not be a great asset for holding long term.

This is because it is a utility token, so it is designed to be spent and used within the Filecoin ecosystem, rather than held for its speculative value like Bitcoin.

At the time of writing – 20 November 2020 – CoinGecko data reports that only 1.85% of the total supply is in circulation. This means that a fully diluted market cap at current prices would place Filecoin at a $58 trillion valuation – about a third of global GDP in 2019.

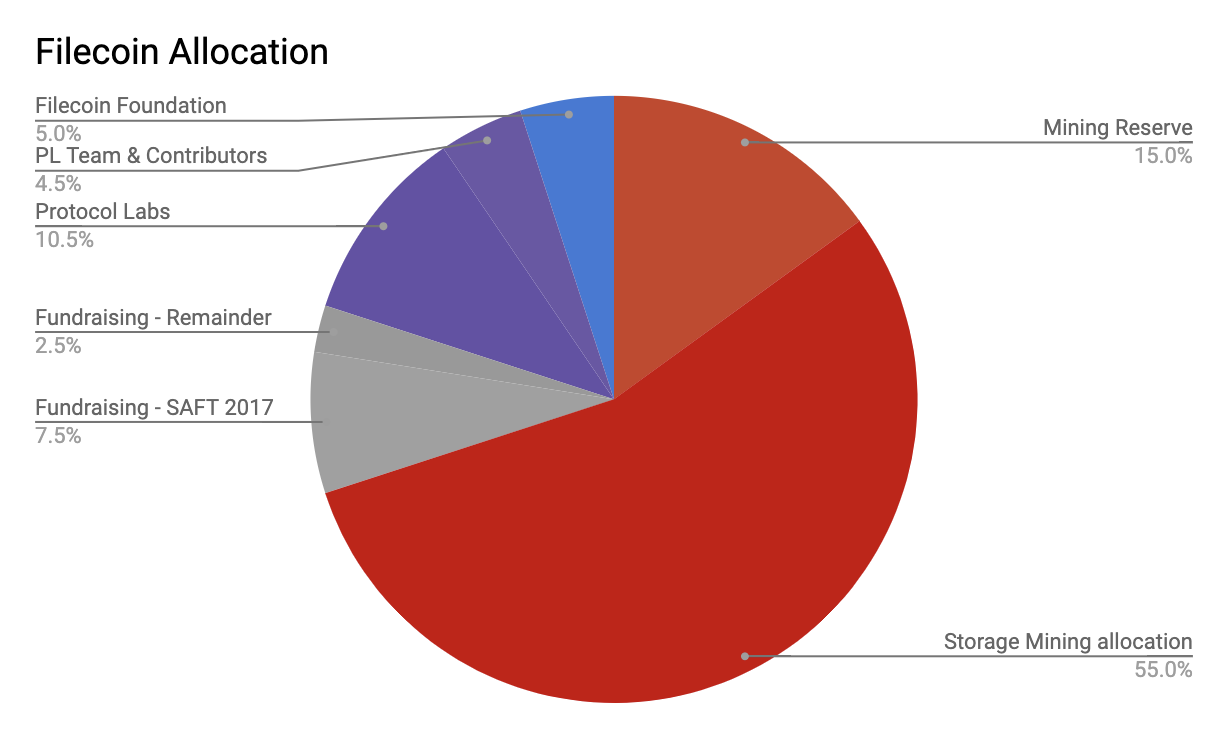

The bulk of tokens are reserved for mining rewards, which makes up 70% of the total supply and will be gradually released over the lifetime of the network. The remaining tokens are already allocated, either sold to investors in the 2017 ICO or reserved in order to fund future development. Much of these funds are in time-locked contracts which will gradually unlock over the next few years, which is why less than 2% of the total supply is currently circulating, despite already being allocated.

Filecoin token allocation as of 20 November 2020 (source: Filecoin Specification)

How to buy Filecoin

Here’s a step-by-step guide to one way of buying Filecoin. Note that there might be other options available, so you may want to compare cryptocurrency exchanges to find the one that’s right for you.

Step 1. Find an exchange

Find an exchange that supports DOT, such as Binance

Step 2. Create an account and make a deposit

Create a Binance account and make a deposit.

Step 3. Buy Filecoin (FIL)

Search for a FIL market and trade a suitable cryptocurrency for FIL.

For example, to buy FIL on the FIL/BTC market you will need to have some Bitcoin to trade for FIL.

Live Filecoin (FIL) price

Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks – they are highly

volatile and sensitive to secondary activity. Performance is unpredictable and past performance is no guarantee of

future performance. Consider your own circumstances, and obtain your own advice, before relying on this information.

You should also verify the nature of any product or service (including its legal status and relevant regulatory

requirements) and consult the relevant Regulators’ websites before making any decision. Finder, or the author, may

have holdings in the cryptocurrencies discussed.