Hence, AMCs are lining up a series of new fund offers (NFO), seeking to meet the need for the resident investor to diversify asset ownership beyond home.

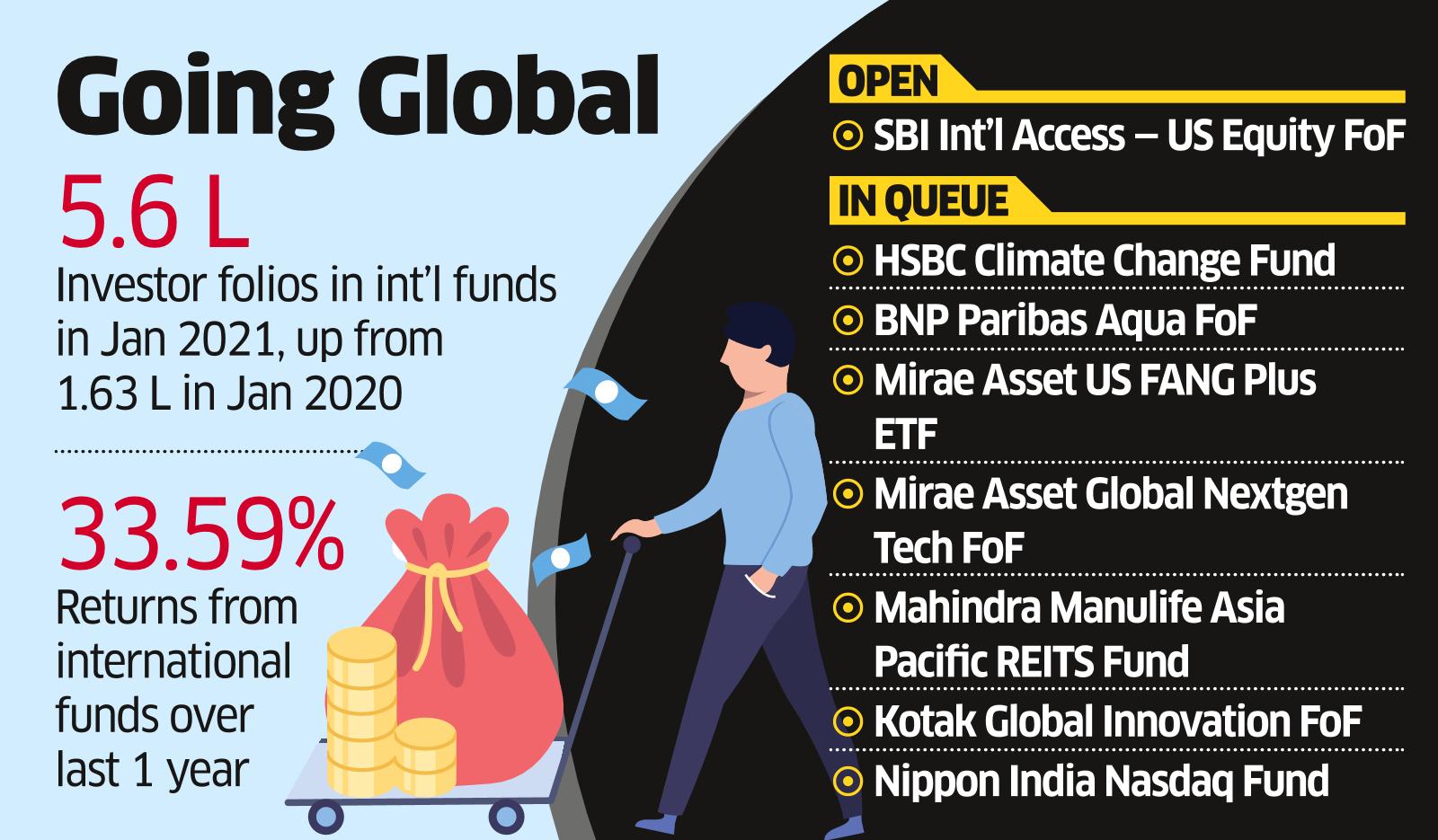

Investor folios in international funds have more than tripled — from 1.63 lakh in January 2020 to 5.6 lakh in January 2021.

SBI MF, the largest fund house by assets, has launched its first product in the international space, ‘SBI International Access – US Equity FoF’. The underlying scheme will be Amundi Funds – US Pioneer Fund. The NFO is open and closes on March 15. In this fund, 80 per cent of the money will be invested in US companies, with the flexibility to invest 20 per cent in non-US companies.

HSBC Climate Change Fund that will invest in innovative companies offering the best solutions for climate challenge opens on March 3. BNP Paribas Aqua Fund of Fund, a niche thematic fund, will invest in companies that cater to water infrastructure, water treatment and utilities. Mirae Asset US FANG Plus ETF is likely to be launched later this month.

“There is a surge in investor appetite for global investing,” said Vineet Nanda, founder, Sift Capital. Non-availability of companies in several technology areas or disruptive businesses and higher returns over the last one year are driving investors to such funds.

Some other fund offerings filed with the regulator and likely to approach investors soon are Mirae Asset Global Nextgen Tech Fund of Fund, Mahindra Manulife Asia Pacific REITS Fund, Kotak Global Innovation Fund of Fund and Nippon India Nasdaq Fund.

Financial planners have been urging investors to make a 10-15 per cent allocation to international equities for geographical diversification as well as a hedge against the dollar. Several Indians looking to send their children abroad for education have started building such allocations as a hedge against the dollar.

Returns from international funds have been high. Value Research data showed this category returned 33.59 per cent over the last one year against the Nifty’s 30.6 per cent.

However, financial planners suggest investors carefully build this portfolio over the next 1-2 years. They point out that themes around water, climate change, etc, are narrow and niche, and need a lot of understanding and continuous monitoring.

“Retail investors could start out with a fund that invests in the broad US markets that accounts for 55 per cent of world market capitalisation, and then add one more fund based on their understanding later, ” said Viral Bhatt, founder, Money Mantra.