getty

getty

Unless you are new to investing and trading you are likely to be having a bit of vertigo at prices for assets in equities and crypto. So let’s look at them and work out what to do.

Crypto is now at about the levels I have been writing about for some time as the very extreme of what the current bull market can carry. I felt it was unlikely to get here, but here it is.

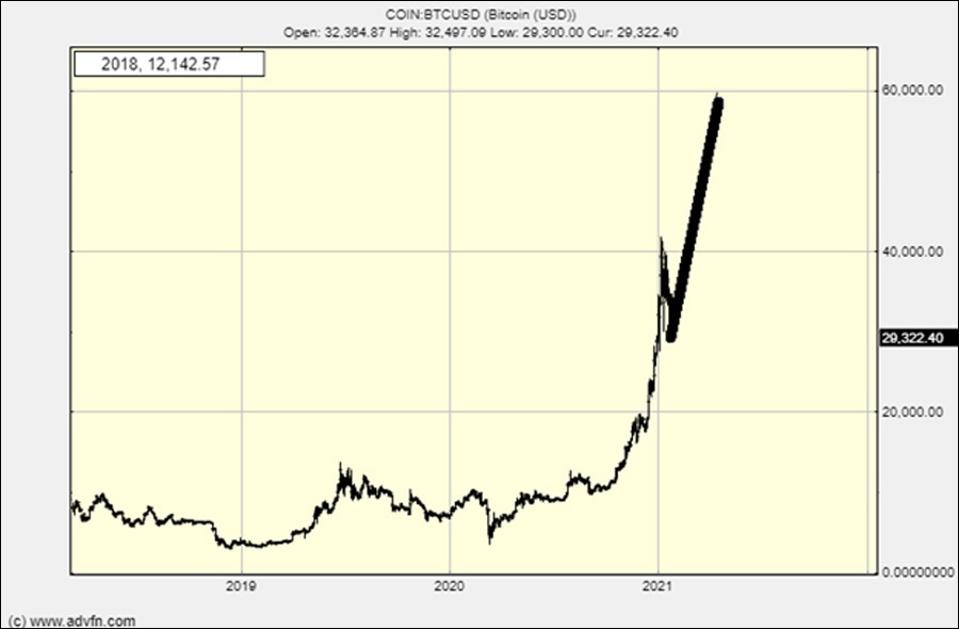

This is a chart from a few weeks ago (it was included in my January 27 post):

The bitcoin chart from January 27

Credit: ADVFN

Now the crypto believers think bitcoin will keep going to 1c a satoshi or $1 million a bitcoin. This is only possible in the near term if hyperinflation shows up and makes dollars much cheaper. This is not impossible, but I feel 100%-200% inflation over the next 5 to 10 years is more likely than 100,000%. High inflation to bring debts back into line with GDP is what I expect, not the implosion of fiat currency. This is not what a lot of my fellow doom-scrollers expect. They see the rapture coming and mountains falling into the sea. I do not expect this. That said, the dollar is on the skids, but that is hardly surprising with a full suite of monetary Gutenbergs at the helm of the U.S.

Here is a dollar chart to show devaluation via liquidity (money printing) at work:

The dollar/euro chart shows the effect of devaluation via money printing

Credit: ADVFN

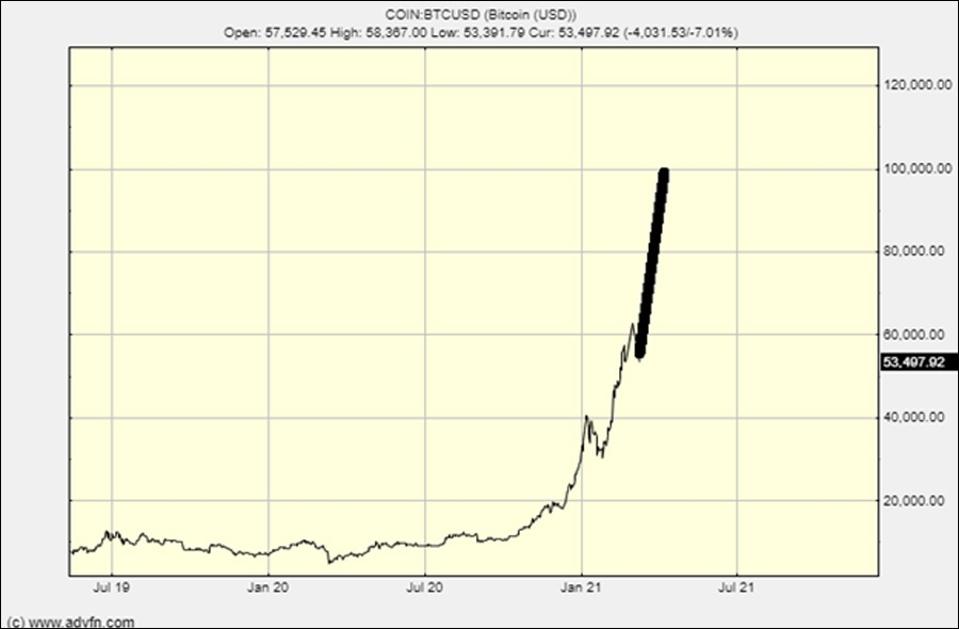

Dollar down, bitcoin up! If $60,000 isn’t the top for bitcoin then the next stop is $100,000, which I do not believe in either, but like the current top $5,000 level my disbelief doesn’t mean it won’t happen.

The bitcoin chart showing a move to $100,000

Credit: ADVFN

This chart looks totally credible to me, but I just can’t get BTC $100,000 to work in my head.

Meanwhile I’m getting the Bitcoin alpha performance with 25% of the “fiat” exposure by riding the amazing market action of DeFi, the new wave of crypto enterprises set to upend the banksters of old. This can be summed up by the apparent fact that Coinbase is currently trading at a valuation bigger than the NYSE and the Nasdaq combined.

It’s a logic that works for Tesla

TSLA

As a side note, the U.K. is driving crypto players out of the United Kingdom just when Britain absolutely needs the sort of “get out of jail” technology that crypto represents. It’s suggestive of Brexit Britain’s status as a “submerging economy.”

Elsewhere crypto has generated about $2 trillion of value and like the sailing ship, crypto will be a technology that will be defining for the future bifurcation of first world nations from the rest. As so many countries have experienced, technology is the driver of societies from backwaters to great powers and vice versa. The great European power of Venice didn’t like sail and preferred oars and so it perished. The current generation of tech will have similar long-term impacts and crypto will be pivotal.

This history lesson and my charting still does not mean bitcoin is going straight up from here to $100,000 or $1 million. The price will have to top out somewhere and it is hard to move a trillion-dollar asset upwards. Yet it is terra incognito, but as far as I’m concerned bitcoin has met all my wildest predictions for the near term.

Equities are not much better priced. It does no good to say for the n’th time how detached equity prices are from the old fundamentals and that the only conclusion to explain the elevation of the stock indexes is to say that inflation is coming fast and stocks are the only place to hide in a convenient instrument.

Most important is to find the answer to the question, what is an investor to do?

There is one chart and only one chart to watch and sadly it’s always about a week delayed. It is the Federal Reserve balance sheet.

Here it is:

The Federal Reserve balance sheet

Credit: Federal Reserve

Everything that is going on in the market and asset prices is coming from the Federal Reserve liquidity programs. That ascending line is all you need to watch. This is where money is born, stuffed into assets and then trickles down until it reaches the “stonks go boom” brigade that say stock only go up.

That has been true since the “credit crunch”/GFC or whatever you want to call it but like bitcoin it can’t be true forever.

But while that balance sheet line rises, so will asset prices (not necessary their “real” value). Subject to an unpredictable piece of terrible news, this is the line to watch. A bigger Fed balance sheet means higher asset prices. It is set to keep ascending for a long time yet, so you must be very brave indeed to want to fight nose-bleed stocks and crypto prices.

So on we go on the long side, damned if you do, cursed if you don’t. As long as the “Fed go Brrrrr” as the young’uns say, I’m holding.

The moment I hear the word “taper” I’m gone.

——-

Clem Chambers is the CEO of private investors website ADVFN.com and author of 101 Ways to Pick Stock Market Winners and Trading Cryptocurrencies: A Beginner’s Guide.

Chambers won Journalist of the Year in the Business Market Commentary category in the State Street U.K. Institutional Press Awards in 2018.