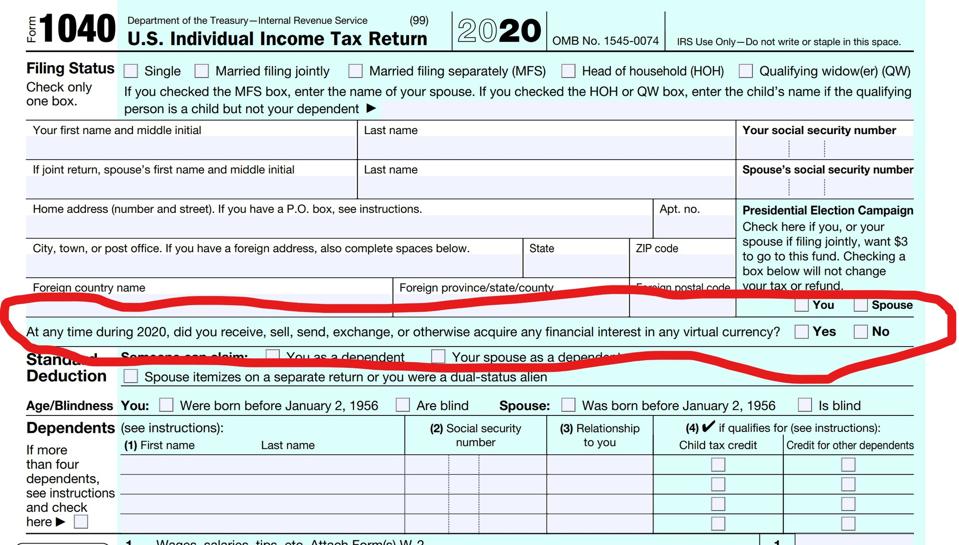

On March 2, the IRS updated the Frequently Asked Questions (FAQs) on Virtual Currency Transactions. The new FAQ provides that taxpayers whose only crypto transactions include the purchase of virtual currency with real currency need not answer yes to the question on the front page of the 2020 IRS Form 1040. This instruction is directly contrary to the plain reading of the simple question on cryptocurrency, which is highlighted in red here:

2020 IRS Form 1040 page 1

GMM

I’ve previously written about IRS enforcement of Crypto account holders here, here, and here. Uncovering crypto account holders is a key part of stepping up enforcement in this area, and as I explained just two weeks ago, the IRS is laser-focused on criminal and civil enforcement in this emerging area of taxation.

Both the 2020 IRS Form 1040 and the 1040 instructions provide that a taxpayer who engaged in any transaction involving virtual currency must check the “yes” box next to the question on page 1 of Form 1040. But the 1040 instructions provide a little more color, explaining that “A transaction involving virtual currency does not include the holding of virtual currency in a wallet or account, or the transfer of virtual currency from one wallet or account you own or control to another that you own or control.”

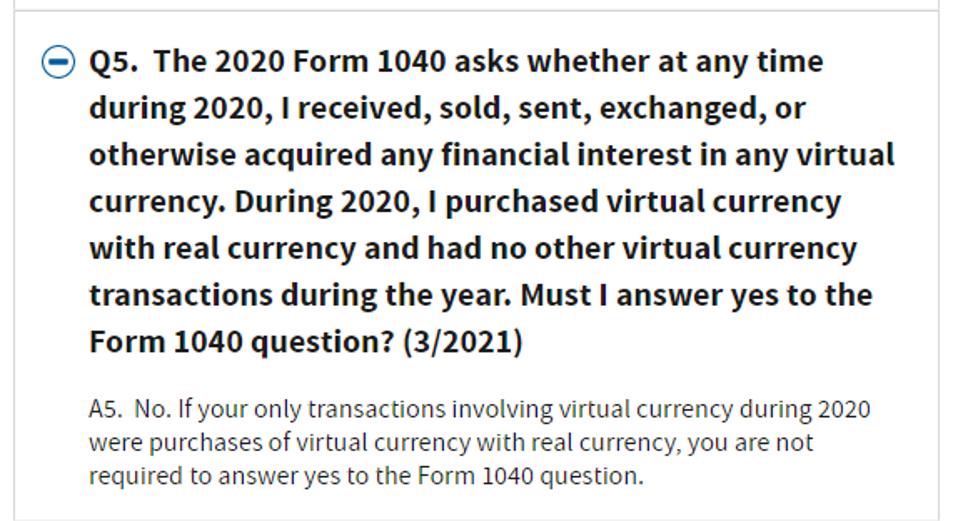

The FAQs released today provide:

Q5 of IRS virtual currency FAQs

GMM

Should crypto account holders who bought, but did not sell, virtual currency in the year 2020 answer “No” to the question based on this FAQ and the 1040 instructions?

I wouldn’t bet a single Bitcoin on it.

First, informal IRS guidance such as FAQs – and even the Internal Revenue Manual – can’t be relied on by taxpayers. Yes, you read that right. The IRS is allowed to and does publish guidance in the form of FAQs and the Internal Revenue Manual to assist taxpayers (and Revenue Agents) in navigating the web of tax law. But there is an abundance of caselaw that says taxpayers don’t have “rights” based on them and can’t try to enforce them. Eaglehawk Carbon, Inc. v. United States, 122 Fed. Cl. 209, 221 (2015) (noting that “it is beyond cavil” that I.R.M. provisions “do[ ] not have the force of law”); Fargo v. Commissioner, 447 F.3d 706, 713 (9th Cir. 2006) (noting that “[th]e Internal Revenue Manual does not have the force of law and does not confer rights on taxpayers”); Valen Mfg. Co. v. United States, 90 F.3d 1190, 1194 (6th Cir. 1996) (noting that [“[t]he provisions of the manual, however, only ‘govern the internal affairs of the Internal Revenue Service. They do not have the force and effect of law,’” quoting United States v. Horne, 714 F.2d 206, 207 (1st Cir. 1983)); and Marks v. Commissioner, 947 F.2d 983, 986, n.1 (D.C. Cir. 1991) (noting that [i]t is well-settled … that the provisions of the [I.R.M.] are directory rather than mandatory, are not codified regulations, and clearly do not have the force and effect of law.”).

Second, answering no to the question when the actual answer is yes based on the FAQ or instructions to the 1040, while technically correct, could lead to adverse consequences. Simply purchasing virtual currency does not create a taxable event. Even if no tax is due in year 2020, if a taxpayer answers no in 2020 based on the FAQ but then does not file a tax return for 2021, or files a tax return that omits a crypto transaction, rest assured that the IRS will argue that answering no in 2020 was evidence of intent to conceal the crypto. And for that matter, so will the Department of Justice, Tax Division. Even if a taxpayer is later vindicated, simply going through an IRS civil or criminal exam can be costly in time, emotional distress, and money on professional fees.

While common sense says it should be perfectly fine to answer “No” based on the FAQ, as a tax litigator who defends clients in civil and criminal tax disputes with the IRS, I’ll advise my clients who bought but did not sell crypto to answer yes, unless there is a compelling non-tax reason not to.