@thedannylesDanny Les

Strategic Advisor to Startups, Corporates & Investors • Mentor • Entrepreneur • London • Opinions my own •

Nothing in this document constitutes financial advice.

Introduction

Welcome, Welcome!

If you are one of the unlucky few who follow me on Twitter, you’ll know that for the past year I’ve often talked about something called ‘Polkadot’ or ‘$DOT’. Very often myself and many others offer thoughts on why we are so excited by it and why we believe it has so much potential. But what exactly is it? And what makes it so exciting?

(Drum roll) Here I present to you an easy to digest answer to those questions and hopefully by the time you’re done reading this you’ll be well up to speed.

Full transparency, I was fortunate enough to have participated in one of the private sale rounds but this has in no way (fully) influenced why I am so incredibly bullish. Read on…

Polkadot is a sprawling blockchain platform with lofty aims, ambitions, and capabilities. Sure, there are plenty of big words thrown around when describing what Polkadot can do, but let’s drill down to the essentials.

At its core, Polkadot is a highly scalable and fully interoperable blockchain protocol upon which the next generation of the web is being built.

When saying this exact sentence to my wife, her response was “fuck off Daniel”.

So if you, like she was (and still is), are already lost at the word “interoperable”, fear not. We’re going to unpack that concept, along with several others, by starting off with an explanation of Polkadot’s most important concept: ushering in the decentralised web era.

What is Polkadot?

Blockchain platforms like Ethereum can do many, many things.

They run decentralised finance (DeFi) applications, blockchain games like Crypto Kitties, and host unique digital collectibles called NFTs.

Blockchains help organisations efficiently track supply chains, issue assets, and enable fast yet inexpensive cross-border transactions on the enterprise side.

Despite these applications, blockchains are hampered by a major roadblock: they don’t play nicely with others. This means they can’t interoperate.

Why should that matter? Because when platforms are non-interoperable, the tendency is to grow one network into monopolistic proportions. Need proof? Look no further than Google, Facebook, and Amazon.

That’s why Polkadot’s core mission is to create and connect a new web of decentralized blockchains, a vision of tomorrow’s internet they call web 3.0. In this new version of the web, trust is implicit in the network, individuals have more power than corporations and governments, and people own their data.

As the Polkadot team puts it in their lightpaper,

If this all sounds extraordinarily ambitious to you, don’t worry — it is. However, the project couldn’t be in more capable hands. Dr. Gavin Wood, the man co-responsible (along with Vitalik Buterin) for creating the Ethereum blockchain, is at the helm here.

So, suffice to say, not only does Dr. Wood know what he’s doing, but he’s also brought along an entire constellation of brilliant scientists from Parity Technologies and the Web 3 Foundation.

Interoperability enables the web 3.0

Ethereum, Neo, Tezos, Cardano — all of these blockchains possess unique features, smart contract capabilities, and functions. But, as a developer or user, you’re bound to each ecosystem. You can’t build across blockchains or seamlessly swap digital assets between them.

To understand why this is a problem, think about the internet. Today’s web uses standard TCP/IP protocols to link and route all devices and information passing through the internet.

Put another way, the TCP/IP protocol enables the countless devices connecting to the internet to speak with one another in a common language.

In contrast, Ethereum speaks Ethereum, Cardano speaks Cardano, but there was no translator between them.

That is, until Polkadot came along.

Polkadot addresses the problem of all of these blockchains operating in silos by acting as an interoperability standard between them. In a way, it’s just like the TCP/IP protocol adopted for the internet, except it enforces decentralization as a rule.

Parachains are the new blockchain

In a nutshell, Polkadot bridges different blockchains, along with giving developers the tools to build new ones, to create a decentralised web of blockchains.

If you’re a visual learner, just think of tons of tiny polkadots on a page. The Polkadot platform links all of these dots, giving them a common ground on which to cooperate.

Every time a blockchain is created on or around the Polkadot standard, it becomes a parachain. The Polkadot blockchain itself is built using Substrate, a broad toolset for building blockchains and digital assets.

When Substrate-built parachains run on Polkadot, they’re conferred all of the advantages of the Polkadot Network, like advanced consensus and high throughput scalability.

Building a standalone blockchain network from scratch is really tough. It’s resource and skill intensive, not to mention you’ll fall into the whole silo category Polkadot is making obsolete. By using Substrate to build a Polkadot-connected parachain, you get simple tools out of the box, helping you go from ‘nocoiner’ to blockchain-based real quick.

Question: Just how quickly can developers launch custom blockchains using Substrate?

Answer: 15 minutes.

Yep, that’s how long it took Polkadot founder Gavin Wood to unwrap a brand new Macbook Pro and create a parachain.

So, in the time it takes to whip up a couple of eggs for breakfast, you can also launch a Polkadot parachain. It’s intentionally easy for a few reasons, the most important being to lower the barrier to entry for as many participants as possible.

However, even more interestingly, Polkadot itself is totally agnostic to the consensus mechanisms of connected parachains. Translation: Private enterprise blockchains, public chains like Ethereum, proof of work networks like Bitcoin — they’re all compatible with Polkadot.

Here’s why Polkadot is exciting

To understand the hype behind Polkadot, you need to step away from all the token price speculation malarkey and look at what’s causing droves of projects to build on and adopt the Polkadot standard.

Why would a new or existing blockchain project want to link up to Polkadot — especially when there are so many blockchain platforms out there?

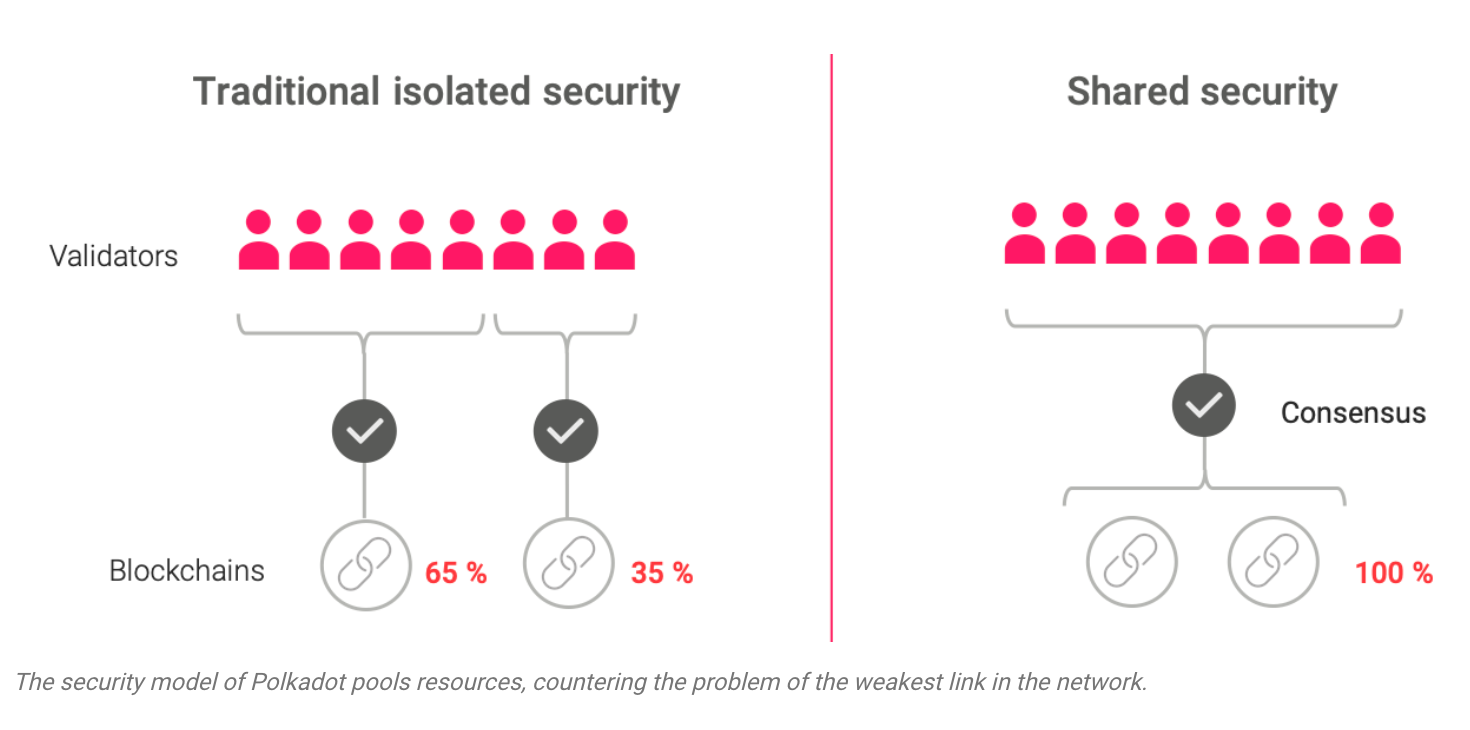

Because Polkadot has its own consensus algorithm (Proof of Authority), incoming blockchains can simply port in, thus taking advantage of what’s called pooled security. Pooled security takes the onus of creating a secure blockchain off the shoulders of parachains, and instead places it on the Polkadot Relay Chain.Since parachains benefit from the Polkadot Relay Chain’s pooled security and sharded scalability, they can instead focus on what matters: their own specialisation. Because independent blockchains are forced to be profitable to survive, they’re forced to build generally rather than specifically. Polkadot lets blockchains get weird, communicate with each other, and swap smart contract data securely and privately.Connecting to the Polkadot Relay Chain enables blockchains to send transactions between one another seamlessly, thus providing true interoperability between networks. For developers, this is especially tasty, as it allows them to build applications using smart contracts and features from different parachains. For DeFi applications, the era of full crosschain swaps is finally upon us.

Polkadot makes true DeFi possible

Decentralised finance has emerged as blockchain’s killer application, but the problems with DeFi today are:

a). It’s not very decentralised

and

b). Scaling is a significant stumbling block

Ethereum hosts the vast majority of DeFi applications. However, it still relies on proof of work consensus, creating expensive bottlenecks every time DeFi applications like Uniswap ramp up the transaction volume.

While network congestion isn’t an indicator of centralisation in and of itself, the centralisation of resources required to operate large scale PoW mining operations is. In other words, a small number of mining pools control most of the Ethereum network hashrate.

In contrast, Polkadot’s proof of authority governance model and low barrier to staking encourage widespread community governance. This quality, paired with Polkadot’s heterogenous sharding capabilities, means DeFi projects can create novel asset formulations using the protocol.

For instance, a DeFi project can easily bridge to Bitcoin, then create an array of BTC-backed (or ‘wrapped’) assets on Polkadot. Such arrangements aren’t mere figments of the imagination — Polkadot DeFi is already here, but more on that later.

Polkadot key features

With Polkadot, you don’t have to make one or the other choices. It’s not a matter of Polkadot or Ethereum. Remember, the key in all of this is interoperability.

Polkadot isn’t meant to kill blockchains. Instead, it’s here to breathe life into them by benefiting all users rather than silo-like individual networks.

These are the core features powering the Polkadot paradigm:

- Countless chains linked by one mesh (the Polkadot Relay Chain)

- Transactions processed in parallel = unlimited scaling capacity

- Blockchain upgrades accomplished without forking

- Blockchain bridges enable open collaboration between developers

- Community governance and network control using DOT token

- Pooled security means blockchains are stronger together

Next, let’s take a look at DOT token, the digital asset tying the project together and the reason by the end of 2021 I’ll likely own a private island.

Polkadot Token ($DOT) Explained

Polkadot token, or $DOT for short, is the network’s native digital asset for governance, staking, and bonding. Let’s take them one at a time.

Bonding

Bonding is a fairly new concept that’s worth covering first. Fairly new because, if you want to be reductionist about it, you could say bonding is just like ICO crowdfunding on Ethereum.

But, just because you could say that doesn’t mean you’re correct. In fact, bonding is quite different from the ICO crowdfunding model.

The ICO model merely trades one token for another. If you want to participate in X ICO, all you do is send ETH or USDT, or some other token to the contract, and you’ll receive Y token in return. Problematically, this doesn’t encourage value to stay on the network, nor does it encourage value to the network’s native token.

Why not? Because the main incentive in traditional ICOs is to dump the crowdfunded tokens into something more stable, like a stablecoin. Countless projects swore to hodl their ETH after raising ICO funds in 2017, only to sell them off as the market cascaded in 2018.

Polkadot avoids this scenario with the bonding mechanism. In the Polkadot realm, ICOs are called IPOs, short for Initial Parachain Offering.

To join the Polkadot as a parachain, new projects need to raise an amount of DOT from the community. The raised $DOT is bonded (locked) to the network for a predetermined amount of time — the longer in duration the parachain slot is, the more $DOT must be bonded.

At the end of the parachain slot duration, the bonded DOT is released back to their owners, whereupon the said parachain can either apply for another slot, or withdraw from the network.

As you can see, the bonding mechanism requires $DOT to be locked rather than sold, thus adding value to the network and $DOT token.

Staking

Under the hood, Polkadot has a powerful consensus mechanism that guarantees security. To keep the mechanism running, the community plays a crucial role through the act of $DOT token staking.

Every transaction passing through the Polkadot Relay Chain needs to be validated. $DOT token holders who do the validating are called…err… validators.

As a validator, you stake your $DOT tokens on the network to do the job of confirming transactions. Basically, you’re saying that transactions on your watch are all true, and are putting up your stake as a guarantee.

Nobody wants to lose their DOT stake by being dishonest and validating false transactions, which is the mechanism by which the process guarantees trust. In return for staking, you earn up to 12% APY.

Governance

At the end of the day, it’s users who are in control of the Polkadot network. Unlike centralised tech corporations who operate in the service of their shareholders, Polkadot users directly make decisions about the network.

To make those decisions and signal ‘skin in the game’, those users must hold $DOT tokens. Additionally, in a move similar to bonding and staking, users voting on community referenda do so by locking their $DOT tokens with their vote.

Locking your tokens in with your vote signals your seriousness about the vote, and keeps community members from selling their votes.

Now, you might be tempted to say that Polkadot governance can favour big shareholders over smaller DOT wallets. Thankfully, that simply isn’t so because of a unique mechanism called time locking.

With time locking, users with a small amount of DOT tokens can leverage a larger stake in the governance mechanism by locking their DOT into referendum votes for longer periods of time.

⏳ Time Lock Example:

Alex: Votes `No` with 10 $DOT for a 128 week lock period ⇒ 10 * 6 = 60 Votes

Simon: Votes `Yes` with 20 DOT for a 4 week lock period ⇒ 20 * 1 = 20 Votes

Jonathan: Votes `Yes` with 15 DOT for a 8 week lock period ⇒ 15 * 2 = 30 Votes

In this way, community members invest their opportunity cost into their vote, thereby keeping small holders in play and mitigating centralisation.

Guide to the Polkadot Ecosystem

Amongst the many exciting new projects are several major blockchains occupying the current top crypto market cap spaces. Ontology, a blockchain for decentralized identity services, is one of them:

Although Polkadot can be harnessed for literally any blockchain application out there, the vast majority of those being built today are in the DeFi sector. Why? Because Polkadot offers the benefits of Ethereum 2.0 today, rather than in several years from now.

Here’s a visual guide to some of the most exciting projects in the Polkadot universe.

Some of the Polkadot related projects I like are:

Acala Network — Crosschain stablecoins, liquidity, and DeFi apps

Polkaswap — An interoperable DEX that is Polkadot’s answer to Uniswap

Kusama Network — A blockchain platform dubbed Polkadot’s wild cousin

Polkastarter — A DEX for crosschain token pools

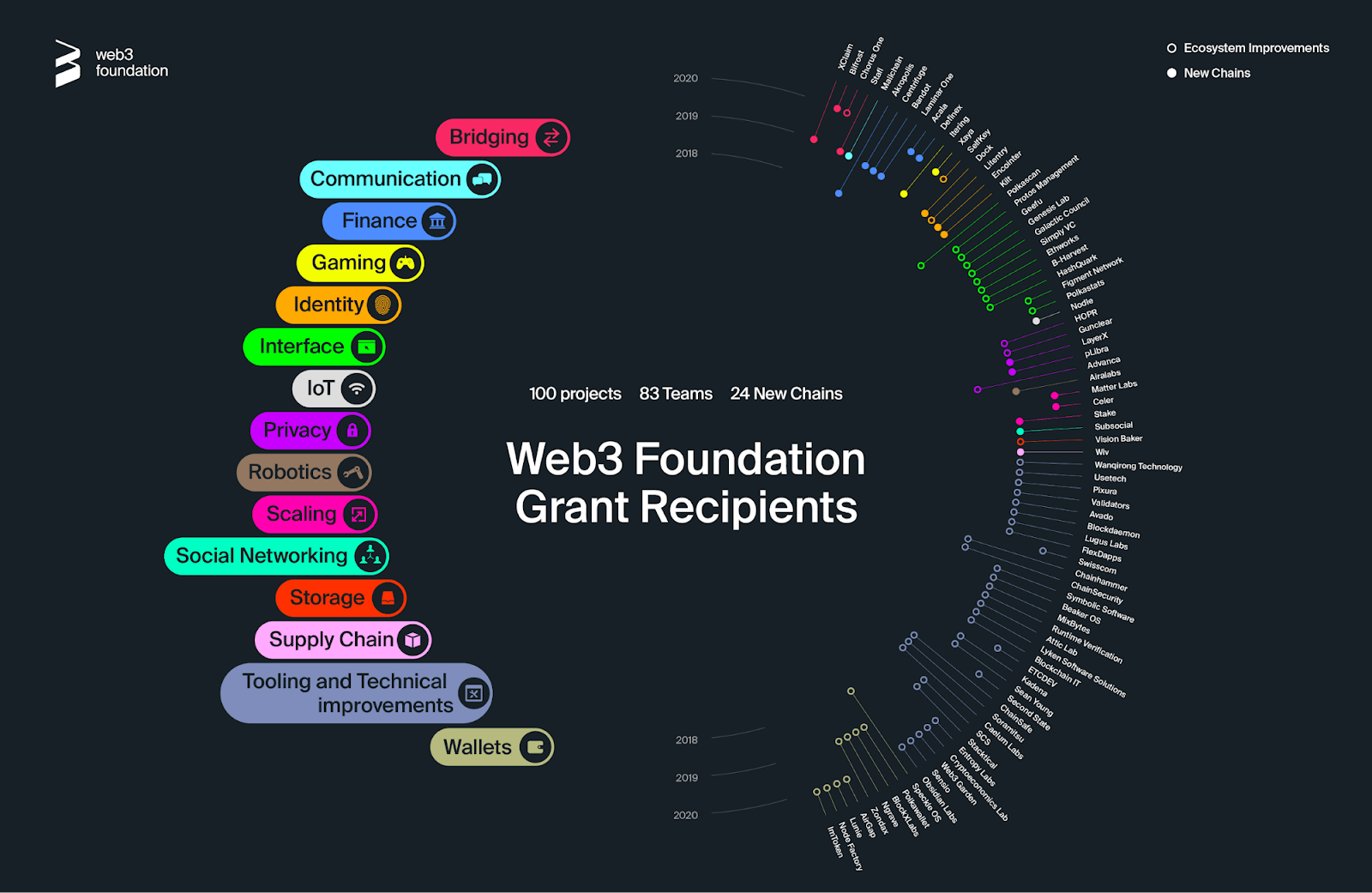

If you want to do an even deeper dive, then you’ll love this resource. It’s a list of all the projects, researchers, and organisations given grants by the Web 3 Foundation. For a visual map of this list, look below 👀👇

Polkadot Resources

If you want to know more you can keep up with the ecosystem by following these great resources:

That’s all I’ve got for you. I finally got around to publishing this after writing the majority of it in November last year (2020) but now seems like an almost optimal time to finally release it as we may just now be getting into (whispers) ‘Altseason’.

Fin.

Also published here.

Tags

Create your free account to unlock your custom reading experience.